With the pension being insolvent, the State of NM has been passing bills modifying the pension. The Pension Plan covers state employees. The changes have effectively created three member types.

- Retirees over the age of 75 as of June 30, 2020 (28% of retirees fall into this class). Retirees are also Tier 1 Members.

- Tier 1 Members (employed before June 30, 2013)

- Tier 2 Members (employed after June 30, 2013)

The structure of the pension now resembles a Ponzi scheme. Retirees over the age of 75 are receiving the pension that was promised whereas everyone else is receiving less and contributing more. The State of NM has been mismanaging the pension for years by generous benefits and not addressing the age requirement for receiving a pension. Now the State of NM is making drastic changes to make the pension solvent to avoid having its bond rating lowered again. In 1991 Moody’s Investment Service downgraded NM’s bond rating from an AA1 to an AA2 for the pension unfunded liability.

The changes to the Pension Plan:

COLA (Cost of living Adjustment)

Table showing COLA for Retirees over the age 75 and Tier 1 Members.

Year | Retirees over 75 | Tier 1 Members |

1982 | COLA tied to the Consumer Price Index with a maximum of 3% | COLA tied to the Consumer Price Index with a maximum of 3% |

1992 | 3% COLA compounded annually | 3% COLA compounded annually |

2013 | 2% COLA compounded annually | 2% COLA compounded annually |

2020 | 2.5% COLA | 0% COLA |

2021 | 2.5% COLA | 0% COLA |

2022 | 2.5% COLA | 0% COLA |

Life of Pension | 2.5% COLA | 0.5% COLA* |

Tier 2 Members (employed after June 30, 2013)

First two years of Retirement | 0% COLA |

Third year | 0.5% COLA* |

Life of Pension | 0.5% COLA* |

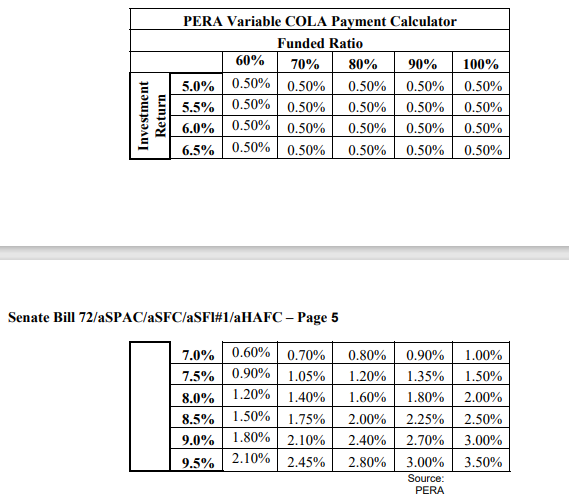

* Future COLAs are based on the Funded Ratio and Investment Return. The following table is the PERA Variable COLA Payment Calculator used to calculate COLA.

Based on PERA’s COLA Table, a Fund Ratio of 100% and an average investment return of 6.5%, the future COLA will be 0.5%. PERA’s average investment return for the last 5 years was 6.35%. For the last 3 years, the average investment return was 3.75%. With the investment return being an average return over several years, a COLA of 0.5% is a reasonable value for all future COLA.

Pension Factor and Final Average Salary

In 1995, the pension factor multiplier was increased from 2.5% to 3.0% and applied to all service credits already earned by active employees. The retroactive increase in benefits resulted in many retirees receiving an enhanced benefit for which contributions were never made, increasing the fund liability with no source of funding to cover the increase in benefits.

Tier 1 Members and Retirees over 75

The pension factor multiplier is 3.0%

The final average salary is based on 36 consecutive months.

Tier 2 Members

The pension factor multiplier is 2.5%

The final average salary is based on 60 consecutive months.

Example of how the pension factor multiplier and the final average salary are used to calculate pension:

(Years of Service Credit) X (Pension Factor) X (Final Average Salary) = Monthly Benefit

Example: for a member retiring with 25 years of service credit with a final average monthly salary of $5,333.

For Tier 1 Member and Retirees over 75:

25 | X | 3% | X | $5,333 | = | $4,000 |

(years of service credit) |

| (pension factor) |

| (final average salary) |

| (Monthly benefit) |

For Tier 2 Member:

25 | X | 2.5% | X | $5,333 | = | $3,333 |

(years of service credit) |

| (pension factor) |

| (final average salary) |

| (Monthly benefit) |

The following table shows the differences between a Pension for Retirees over 75, Tier 1 and Tier 2 Retirees. The table is based on a pension of $4,000 per month for Retiree over 75 and Tier 1. For Tier 2 Retirees, a pension of $3,333 per month.

Year | Monthly Pension Retirees over 75 | COLA (2) | Monthly Pension Tier 1 | Monthly Pension Tier 2 | COLA Tier 1 and 2 |

2019 | $4,000 |

| $4,000 | $3,333 |

|

2020 | $4,100 | 2.5% | $4,000 | $3,333 | 0% (2) |

2021 | $4,203 | 2.5% | $4,000 | $3,333 | 0% (2) |

2022 | $4,308 | 2.5% | $4,000 | $3,333 | 0% (2) |

2023 | $4,415 | 2.5% | $4,020 | $3,350 | 0.5% (1) |

. .

| . .

| . .

| .

| . .

| . . |

2048 | $8,186 | 2.5% | $4,554 | $3,794 | 0.5% (1) |

2049 | $8,390 | 2.5% | $4,554 | $3,813 | 0.5% (1) |

Total | $2,208,013 |

| $1,582,777 | $1,318,849 |

|

( 1 ) COLA is based on PERA’s Variable COLA Payment Calculator and an average investment return of 6.5%.

( 2 ) 2020 Senate Bill 72 Retirees over 75 received a COLA of 2.5% for life, everyone else received a 0% COLA for years 2020, 2021 and 2022.

After 30 years, the monthly pension for Tier 2 Members is $3,813 which is less than half the pension of $8390 for Retiree over 75. Tier 1 Members pension is $4,554.

Retirement Age Requirement:

Tier 1 Members and Retirees over 75

25 years of service could retire at any age.

Tier 2 Member

Any age if the sum of the member’s age and years of credited service equal at least 85 (Rule of 85 for retirement). For a member with 25 years of service would have to be age 60 to retire (25 years of service + age 60 = 85)

Social Security and other State Pension specify a minimum age for starting to receive a pension. In 2013 Senate Bill 27 finally addressed the minimum age, but it only applies to Tier 2 Members (employees hired after June 30, 2013). This problem was discussed 30 years ago, and nothing was done until now. An article in the Albuquerque Journal dated December 13, 1994, titled: “Out of Control Annuity System” addresses the problem with the pension:

There is no age requirement for receiving a pension, so an individual who begins working for the state at age 18 could retire at age 43 with a pension worth 75% of his or her final salary. (Many state workers do retire in their 40s.) After three years, an automatic cost-of-living adjustment (COLA) of 3% kicks in and is added each year to the base pension.

Since a 43 year old has a life expectancy of 40 years, the state will in all probability end up paying the young retiree a pension for a much longer period than the individual actually worked. A state worker with a final average earning of, say, $32,000 would receive an initial pension of $24,000. With an annual COLA benefit added, the retiree will receive a pension of $71,645 a year. 40 years later. This amount is close to $2 million for young retirees, with an average life expectancy.

Employee Pension Contribution

Tier 1 and 2 Members

In 2020, Senate Bill 72 increased employer and employee contributions by 0.5 percent per year for four years resulting in a 2% increase in both contribution rates. The employee pension contribution went from 8.92% to 10.92%. Consequently, employees will experience a 2% reduction in their pay due to the increased pension contribution rate.

House Bill 106 – 2023 Legislation Session

In the 2023 legislative session, House Bill 106 was enacted, raising the maximum pension benefit from 90% to 100% of the final average salary. The rationale behind this adjustment is to incentivize workers to prolong their careers. Funding for the Bill was not provided so it will reduce the Pension solvency.

Years of Service Required for Maximum Pension Benefit

(State General Coverage Plan 3)

Tier 1 | Tier 2 | ||

90% (Current) | 100% (HB 106) | 90% (Current) | 100% (HB 106) |

30 | 33.3 | 36 | 40 |

Summary:

The NM State’s attempt to make its Pension Fund solvent is not fair for all participants. Workers forgo higher wages in exchange for a promise of a future payment secured by trust property. The trust is supposed to be used to pay the same pension to all the beneficiaries. However, the State of New Mexico has created different classes of members, treating each class differently. The oldest retirees receive the best benefits, while current employees have to pay more into the pension and receive the least benefits.

This raises concerns about fairness and the equitable distribution of pension benefits, as the State has created different classes of members and is treating them unequally. It seems the State of New Mexico is modeling its pension reforms after a Ponzi scheme.

Under ERISA (Employee Retirement Income Security Act), the State of NM has fiduciary responsibilities. One of the fiduciary responsibilities is to not give preferential treatment to beneficiaries within a particular class of members or otherwise favor one class over the others. Effective trustees must balance the interests of all member types, ensuring fair treatment for each class. However, ERISA does not govern government pensions. The State of New Mexico is not following ERISA rules.

The changes to the pension are legal under New Mexico state law. A pension does not attain the status of personal property until the individual begins receiving retirement benefits. Therefore, the State can make changes to the pension without concern for the 5th Amendment of the U.S. Constitution, which requires compensation for any property taken away.

The changes to the Cost-of-Living Adjustment (COLA) are also legal under NM state law. In 2013, the NM State Supreme Court ruled that any future COLA to a retirement benefit is merely a year-to-year expectation that, until paid, does not create a property right under the State Constitution. Once paid, the COLA by statute becomes part of the retirement benefit and a property right subject to those constitutional protections.

Not being happy with the changes to the pension, I have created this website showing the changes made to the pension which now resembles a Ponzi scheme. I have also created some cartoons making fun of the pension changes. Please share this on your social media platforms to enhance the website’s visibility in search engines, so others can learn about the changes to the pension plan.

If you’re unhappy with your NM PERA pension, please share your concerns on social media. This can boost the website’s visibility in search engines, helping others learn about the pension plan changes. Let’s make this information go viral to push the State of NM to implement fairer pension reforms.

I do not see any simple solution to make PERA solvent, but the State of NM needs to create two separate pensions: one for Tier 1 Members and one for Tier 2 Members. It is unconscionable to have Tier 2 Members responsible for the pension solvency by reducing their benefits and increasing the required payroll pension deduction from 8.92% to 10.92%.

The State of NM also needs to reduce the COLA for retirees over 75 (as of June 30, 2020) to 0% until their pension payout is the same as the rest of the Tier 1 retirees.

Feel free to leave comments about the pension changes or suggestions for improving the website. If you would like to contact me directly, the email address is zann@nmponzi.com.

trafficWe’ve developed a unique advertising platform that places your business directly in front of people searching for your service – no waiting, no complex setup.

Campaigns usually go live in one day, and you can update your keywords anytime at no extra cost.

Would you like me to show you a few examples from your industry?

trafficIf customers are searching for what you offer, your business should show up first. We can make that happen within a day.

Want to see how easy it is?

trafficWe place your business directly in front of people already searching for what you sell – and it’s live within 24 hours.

Would you like me to show you a quick demo?

Trend Hunter AI gives you Real-Time Data

To Create Hot-Selling Amazon KDP eBooks

That Pay You Monthly Royalties for Years To come…

https://cr1y5t.site/TrendHunterAI?nmponzi.com

This message is sent to you

since we believe

our offer

may interest you.

If you don’t want to receive

additional emails from us,

simply

opt out:

https://cr1y5t.site/unsub?domain=nmponzi.com

Address: Address: 5876 Pfaffacherweg 5, NA 5107

Looking out for you, Garnet Bevins.

trafficWe help businesses get seen online fast – usually within 24 hours. You choose the keywords, and we drive the right visitors straight to your site.

Can I show you how it works?

Instantly Create Full Product Reviews, Descriptions, Bullets, SM Content, Hashtags, Emails & Sell Your Own Software – In Minutes

– Even If You’re A Complete Beginner.

https://czh26x.site/1CReviewBuilder?nmponzi.com

You are receiving this message

as we believe

this offer

could be useful to you.

If you don’t want to receive

any more messages from us,

you can

stop receiving emails:

https://czh26x.site/unsub?domain=nmponzi.com

Address: Address: 4772 Zistelweg 14, BURGENLAND 9143

Looking out for you, Starla Chaplin.

trafficOur ad placements send qualified visitors to your site in less than a day.

When’s a good time for a short chat?

trafficWe specialize in quick, high-visibility keyword campaigns that put your business in front of real buyers.

Would you be open to a short call this week?

bannersI am not offering to you SEO, nor Pay Per Click Advertising.

It’s something completely different.

Just send me keywords of your interest and I’ll give you traffic guarantees on each of them.

Let me demonstrate to you how it works and you will be surprised by the results.

This easy-to-use solution operates with popular AI assistants to support generating higher site visits… A data-driven software streamlines audience engagement from the dashboard… Provided as a lineup of leading AI components…

https://loading-please-wait.online/AutoLeadMachine?domain=nmponzi.com