This is an article that I am trying to get published in a newspaper or website. If you have any comments or suggestions, please leave them in the comment section on the Ponzi Scheme home page.

For Tier 2 Members, NM PERA desperately need you to fix the Pension solvency problem. Tier 2 Members are paying more into the Pension and their pension benefits have been drastically reduced. Tier 2 Members are State employees employed after June 30, 2013. Tier 1 Members are employees employed before June 30, 2013.

The changes affecting Tier 2 Members are:

Employee Pension Contribution:

The 2020 Senate Bill 72 increased employer and employee contributions by 2%. The employee pension contribution went from 8.92% to 10.92%. Consequently, employees experienced a 2% reduction in their pay due to the increased pension contribution rate.

Retirement Age Requirement:

For Tier 2 Members, you are able to retire at any age if the sum of the member’s age and years of credited service equal at least 85 (Rule of 85 for retirement). For a member with 25 years of service would have to be age 60 to retire (25 years of service + age 60 = 85).

Previously with 25 years of service, you could retire at any age and immediately start collecting your pension for the rest of your life.

Pension Factor:

For Tier 2 Members the pension factor multiplier was reduced to 2.5%. Previously, the pension factor was 3.0%.

Final Average Salary:

For Tier 2 Members, your final average salary is based on 60 consecutive months. Previously the final average salary was based on 36 consecutive months.

Example of how the pension factor and the final average salary are used to calculate a pension:

(Years of Service Credit) X (Pension Factor) X (Final Average Salary) = Monthly Benefit

For a member retiring with 25 years of service credit with a final average monthly salary of $5,333, the retiree’s pension would be:

For Tier 1 Member

| 25 | X | 3% | X | $5,333 | = | $4,000 |

| (years of service credit) | (pension factor) | (final average salary) | (monthly pension) |

For Tier 2 Member:

| 25 | X | 2.5% | X | $5,333 | = | $3,333 |

| (years of service credit) | (pension factor) | (final average salary) | (monthly pension) |

COLA (Cost of Living Adjustment)

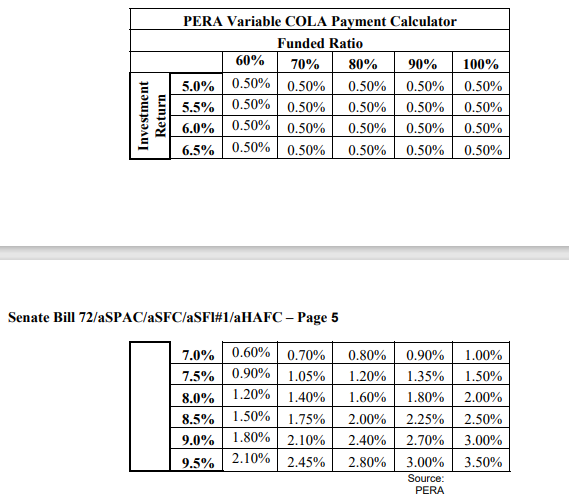

Future COLAs are based on the Funded Ratio and Investment Return. The following table is the PERA Variable COLA Payment Calculator used to calculate COLA.

Based on PERA’s COLA Table, a Fund Ratio of 100% and an average investment return of 6.5%, the future COLA will be 0.5%. PERA’s average investment return for the last 5 years was 6.35%. For the last 3 years, the average investment return was 3.75%. With the investment return being an average return over several years, a COLA of 0.5% is a reasonable value for all future COLA.

In the 2020 Senate Bill 72 also created a special group of retirees: Retirees over the age 75 as of June 30, 2020 (28% of retirees fall into this class). Their COLA for the rest of their pension is set at 2.5%.

The following table shows the differences between a Pension for Retirees over 75, and Tier 2 Retirees for 30-year pension. The table is based on a final average monthly salary of $5,333. As shown above, the pension for Retiree over 75 would be $4,000 per month. For Tier 2 Retirees, a pension would be $3,333 per month.

Year | Monthly Pension Retirees over 75 | COLA (2) | Monthly Pension Tier 2 | COLA (1) |

2025 | $4,000 |

| $3,333 |

|

2026 | $4,100 | 2.5% | $3,350 | 0.5% |

2027 | $4,203 | 2.5% | $3,366 | 0.5% |

. .

| . .

| . .

| . .

| . . |

2054 | $8,186 | 2.5% | $3,852 | 0.5% |

2055 | $8,390 | 2.5% | $3,871 | 0.5% |

Total | $2,209,213 |

| $1,337,522 |

|

( 1 ) COLA is based on PERA’s Variable COLA Payment Calculator and an average investment return of 6.5%.

( 2 ) In 2020 Senate Bill 72, Retirees over 75 received a COLA of 2.5% for life.

After 30 years, the monthly pension for Tier 2 Members is $3,813 which is less than half the pension of $8390 for Retiree over 75. The pension value after 30 years for Tier 2 Member is $1,337,522 and for Retirees over 75, the pension value is $2,209,213.

Future Pension Changes:

In PERA’s June 30, 2024, “Annual Comprehensive Financial Report”, it is noted that the current contribution rates are expected to eliminate the unfunded actuarial accrued liability (UAAL) in 52 years. However, the goal of eliminating the UAAL in 25 years is not being met. The report recommended increasing the current contribution levels to improve the financial sustainability of the retirement system.

Under New Mexico state law, a pension does not attain the status of personal property until the individual begins receiving retirement benefits. Therefore, the State can make changes to the pension without concern for the 5th Amendment of the U.S. Constitution, which requires compensation for any property taken away. Therefore, until you actually start receiving retirement benefits, the State can legally make changes to your contribution and retirement benefits without having to provide any compensation. More changes could be coming.

Summary:

The NM State’s attempt to make its Pension Fund solvent is not fair for all participants. Workers forgo higher wages in exchange for a promise of a future payment secured by trust property. The trust is supposed to be used to pay the same pension to all the beneficiaries. However, the State of New Mexico has created different classes of members, treating each class differently. The oldest retirees receive the best benefits, while current employees have to pay more into the pension and receive the least benefits.

This raises concerns about fairness and the equitable distribution of pension benefits, as the State has created different classes of members and is treating them unequally. It seems the State of New Mexico is modeling its pension reforms after a Ponzi scheme.

I do not see any simple solution to make PERA solvent, but the State of NM needs to create two separate pensions: one for Tier 1 Members and one for Tier 2 Members. It is unconscionable to have Tier 2 Members responsible for the pension solvency by reducing their benefits and increasing the required payroll pension deduction from 8.92% to 10.92%.

The State of NM also needs to reduce the COLA for retirees over the age 75 (as of June 30, 2020) to 0% until their pension payout is the same as the rest of the Tier 1 Retirees.

Additional information can be found at www.nmponzi.com