Pension Changes

The following section is a more complete history of the changes that the State of New Mexico has made to the NM PERA Pension. The Pension Plan covers state employees.

In 1995, the service credit multiplier was increased by 0.5% from 2.5% to 3.0%, and applied to all service credit already earned by active employees. The retroactive increase in benefits resulted in a number of retirees receiving an enhanced benefit for which contributions were never made, increasing the fund liability with no source of funding to cover the increase in benefits. The retirees over age 75 is the group that benefited the most from the change.

2013 – Senate Bill 27

Senate Bill 27 created two tiers of member’s benefits.

Tier 1 Members (Active members employed by June 30, 2013). The changes made to their pension:

- The Cost-of-Living Adjustment (COLA) was changed from 3% to 2%. Retirees with 25 years of service with an annual pension of $20,000 or less will receive a 2.5 % annual compounding COLA.

- People who retired between July 1, 2015, and June 1, 2016, would have to wait four calendar years to receive their first COLA. Previously, retirees only had to wait two years to receive their first COLA.

- People who retired after July 1, 2016, would have to wait seven years to receive their first COLA.

Tier 2 Members (Active members employed after June 30, 2013). The changes made to their pension:

- The Cost-of-Living Adjustment (COLA) was changed from 3% to 2%. Retirees with 25 years of service with an annual pension of $20,000 or less will receive a 2.5 % annual compounding COLA.

- Retirement age requirement: Any age if the sum of the member’s age and years of credited service equal at least 85 (Rule of 85 for retirement). For a member with 25 years of service would have to be age 60 to retire (25 years of service + age 60 = 85). For Tier 1 Member with 25 years of service could retire at any age.

- The final average salary is based on 60 consecutive months of credited service producing the largest average. For Tier 1 Members, it is based on 36 consecutive months.

- Retirement on or after July 1, 2016, seven full calendar years eligible period to receive COLA.

- The pension factor per year of credited service is 2.5%. For Tier 1 Members, the pension factor is 3.0%. The formula for calculating the Pension benefits is:

Years of Service Credit X Pension Factor X Final Average Salary = Monthly Benefit

Example: for a member retiring with 25 years of service credit with a final average monthly salary of $5,333.

For Tier 1 Member:

25 | X | 3% | X | $5,333 | = | $4,000 |

(years of service credit) |

| (pension factor) |

| (final average salary) |

| (monthly benefit) |

For Tier 2 Member:

25 | X | 2.5% | X | $5,333 | = | $3,333 |

(years of service credit) |

| (pension factor) |

| (final average salary) |

| (monthly benefit) |

2018 Downgrade of Bond Rating.

In 2018, Moody’s Investor Service issued a Bond rating downgrade from an AA1 toAA2. One of the items causing the downgrade was the growing pension liability.

March 2020 Senate Bill 72

The changes that Senate Bill 72 made:

For the years 2020, 2021 and 2022, the COLA will be a check equal to 2% of your annual pension amount. The 2% check is non compounding and referred to as 2% non-compounding 13th check. The following retirees were exempt from the 2% non-compounding 13th check and receive a 2.5% COLA for the three years.

- Retirees who attained at least age 75 as of June 30, 2020 (28% of retirees fall into this category).

- Retirees who retired with at least 25 years of service and whose annual pension is $25,000 or less

- Disable retirees who annual pension is $25,000 or less (3% of retirees fall into the last two categories)

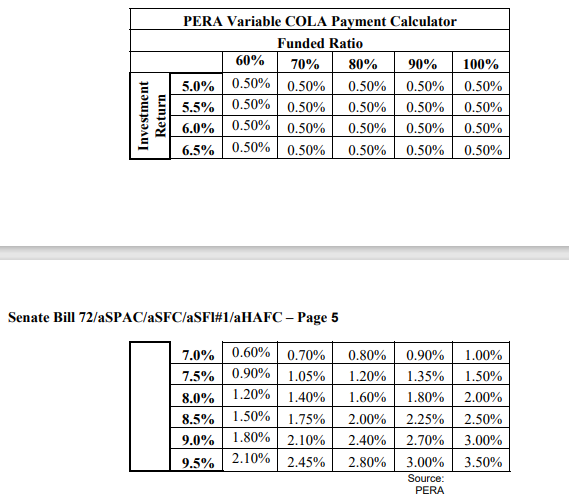

Beginning July 1, 2023, transitioning from a static fixed 2.0 percent COLA to a profit-sharing model where COLA is dependent on both investment performance and the plan’s funded status. For 2023 and 2024 the COLA was 0.5%. The following table is PERA Variable COLA Payment Calculator. The variable COLA is based on the Funded Ratio and Investment Return. Investment Return is based on an average of several years and not the return from one year.

The following retirees are exempt from the profit-sharing COLA and will receive a 2.5% COLA for the rest of their life.

- Retirees who attained at least age 75 as of June 30, 2020 (28% of retirees fall into this category)

- Retirees who retired with at least 25 years of service and whose annual pension is $25,000 or less

- Disable retirees who annual pension is $25,000 or less (3% of retirees fall into the last two categories)

SB 72 increases employer and employee contributions by 0.5 percent per year for four years resulting in a 2% increase in both contribution rates. The employee pension contribution went from 8.92% to 10.92%. Effectively, employees will receive a 2% reduction in their pay from the contribution increase rate to the pension.

House Bill 106 – 2023 Legislation Session

In the 2023 legislative session, House Bill 106 was enacted, raising the maximum pension benefit from 90% to 100% of the final average salary. The rationale behind this adjustment is to incentivize workers to prolong their careers. In the Fiscal Impact Report, PERA’s analysis claims the impact on Pension was minor. The funding source for the Bill was not provided.

Years of Service Required for Maximum Pension Benefit

(State General Coverage Plan 3)

Tier 1 | Tier 2 | ||

90% of final average salary (Current) | 100% of final average salary (HB 106) | 90% of final average salary (Current) | 100% of final average salary (HB 106) |

30 | 33.3 | 36 | 40 |