This is an article that I am trying to get published in a newspaper or website. If you have any comments or suggestions, please leave them in the comment section on the Ponzi Scheme home page.

The changes that the NM State Government made to the PERA Pension for state employees now resemble a Ponzi Scheme. The older retirees are receiving the Pension that was promised where the Tier 2 members are paying more into the Pension and receiving the least benefits.

The 2020 Senate Bill 72 has effectively created three member types:

- Retirees over 75 as of June 30, 2020 (28% of retirees fall into this class). Retirees are also Tier 1 Members.

- Tier 1 Members (employed before June 30, 2013)

- Tier 2 Members (employed after June 30, 2013)

The changes to the Pension are:

COLA (Cost of Living Adjustment)

Table showing COLA for Retirees over 75 and Tier 1 Members

Year | Retirees over 75 | Tier 1 Members |

1982 | COLA tied to the Consumer Price Index with a maximum of 3% | COLA tied to the Consumer Price Index with a maximum of 3% |

1992 | 3% COLA compounded annually | 3% COLA compounded annually |

2013 | 2% COLA compounded annually | 2% COLA compounded annually |

2020 | 2.5% COLA | 0% COLA |

2021 | 2.5% COLA | 0% COLA |

2022 | 2.5% COLA | 0% COLA |

Pension Life | 2.5% COLA | 0.5% COLA* |

For Tier 2 Members (employed after June 30, 2013)

First two years of Retirement | 0% COLA |

Third year | 0.5% COLA* |

Pension Life | 0.5% COLA* |

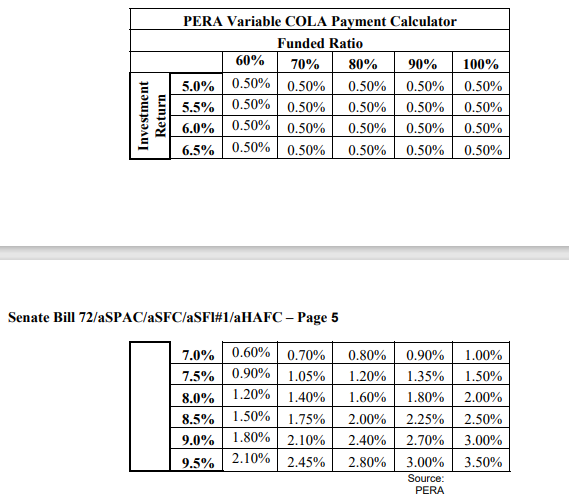

* Future COLAs are based on the Funded Ratio and Investment Return. The following table is the PERA Variable COLA Payment Calculator used to calculate COLA.

Even with a Fund Ratio of 100% and investment return of 6.5%, the future COLA will be 0.5%. PERA’s average investment return for the last 4 years was 5.8%. With the investment return being an average return over several years, a COLA of 0.5% is a reasonable value of future COLA.

Pension Factor and Final Average Salary

In 1995, the pension factor multiplier was increased from 2.5% to 3.0% and applied to all service credits already earned by active employees. The retroactive increase in benefits resulted in many retirees receiving an enhanced benefit for which contributions were never made, increasing the fund liability with no source of funding to cover the increase in benefits. For Tier 2 members, the pension factor was reduced to 2.5%.

The employee pension is based on the Final Average Salary.

Tier 1 Members and Retirees over 75

The pension factor multiplier is 3.0%

The final average salary is based on 36 consecutive months.

Tier 2 Members

The pension factor multiplier is 2.5%

The final average salary is based on 60 consecutive months.

Example of how the pension factor and the final average salary are used to calculate pension:

(Years of Service Credit) X (Pension Factor) X (Final Average Salary) = Monthly Benefit

Example: for a member retiring with 25 years of service credit with a final average monthly salary of $5,333.

For Tier 1 Member and Retirees over 75:

25 | X | 3% | X | $5,333 | = | $4,000 |

(years of service credit) |

| (pension factor) |

| (final average salary) |

| (monthly pension) |

For Tier 2 Member:

25 | X | 2.5% | X | $5,333 | = | $3,333 |

(years of service credit) |

| (pension factor) |

| (final average salary) |

| (monthly pension) |

The following table shows the differences between a Pension for Retirees over 75, Tier 1 and Tier 2 retirees. The table is based on a pension of $4,000 per month for Retiree over 75 and Tier 1. For Tier 2 retirees, a pension of $3,333 per month.

Year | Monthly Pension Retirees over 75 | COLA (2) | Monthly Pension Tier 1 | Monthly Pension Tier 2 | COLA Tier 1 and 2 |

2019 | $4,000 |

| $4,000 | $3,333 |

|

2020 | $4,100 | 2.5% | $4,000 | $3,333 | 0% (2) |

2021 | $4,203 | 2.5% | $4,000 | $3,333 | 0% (2) |

2022 | $4,308 | 2.5% | $4,000 | $3,333 | 0% (2) |

2023 | $4,415 | 2.5% | $4,020 | $3,350 | 0.5% (1) |

. .

| . .

| . .

| .

| . .

| . . |

2048 | $8,186 | 2.5% | $4,554 | $3,794 | 0.5% (1) |

2049 | $8,390 | 2.5% | $4,554 | $3,813 | 0.5% (1) |

Total | $2,208,013 |

| $1,582,777 | $1,318,849 |

|

( 1 ) COLA is based on PERA’s Variable COLA Payment Calculator and an average investment return of 6.5%.

( 2 ) 2020 Senate Bill 72 Retirees over 75 received a COLA of 2.5% for life, everyone else received a 0% COLA for years 2020, 2021 and 2022.

After 30 years, the monthly pension for Tier 2 Members is $3,813 which is less than half the pension of $8390 for Retiree over 75. Tier 1 Members pension is $4,554.

Retirement Age Requirement:

Tier 1 Members and Retirees over 75

25 years of service could retire at any age.

Tier 2 Member

Any age if the sum of the member’s age and years of credited service equal at least 85 (Rule of 85 for retirement). For a member with 25 years of service would have to be age 60 to retire (25 years of service + age 60 = 85)

Employee Pension Contribution

Tier 1 and 2 Members

The 2020 Senate Bill 72 increased employer and employee contributions starting in 2021 by 0.5 percent per year for four years resulting in a 2% increase in both contribution rates. The employee pension contribution went from 8.92% to 10.92%. Consequently, employees will experience a 2% reduction in their pay due to the increased pension contribution rate.

Summary:

The NM State’s attempt to make its Pension Fund solvent is not fair for all participants. Workers forgo higher wages in exchange for a promise of a future payment secured by trust property. The trust is supposed to be used to pay the same pension to all the beneficiaries. However, the State of New Mexico has created different classes of members, treating each class differently. The oldest retirees receive the best benefits, while current employees have to pay more into the pension and receive the least benefits.

This raises concerns about fairness and the equitable distribution of pension benefits, as the State has created different classes of members and is treating them unequally. It seems the State of New Mexico is modeling its pension reforms after a Ponzi scheme.

I do not see any simple solution to make PERA solvent, but the State of NM needs to create two separate pensions: one for Tier 1 Members and one for Tier 2 Members. It is unconscionable to have Tier 2 Members responsible for the pension solvency by reducing their benefits and increasing the required payroll pension deduction from 8.92% to 10.92%.

The State of NM also needs to reduce the COLA for retirees over 75 (as of June 30, 2020) to 0% until their pension payout is the same as the rest of the Tier 1 retirees.

Additional information can be found at www.nmponzi.com